Best Instant Loan Apps You Should Know

- 1 Top Best Instant Loan Apps

- 1.1 PaySense

- 1.2 LazyPay

- 1.3 Bajaj Finserv

- 1.4 IDFC FIRST Bank

- 1.5 Dhani

- 1.6 HomeCredit

- 1.7 CASHe

- 1.8 KreditBee

- 1.9 Fullerton India

- 1.10 Fibe

- 2 FAQs

When credit is an issue, instant lending applications might be a lifesaver. Instead of looking at your credit history or CIBIL Score, these apps analyze your social credibility score to evaluate if you qualify for a loan. Signing up, registering, and exchanging credit facilities based on consumer information is easy with these lending applications. Your request will be immediately approved after completing KYC and accepting the terms and services. The process is digital and non-contact. Anywhere from 5 minutes to 2 days is possible. PaySense, LazyPay, IDFC FIRST Bank, etc., are just a few websites that provide personal loans. Examine each option’s features, cost, and stipulations before deciding.

Top Best Instant Loan Apps

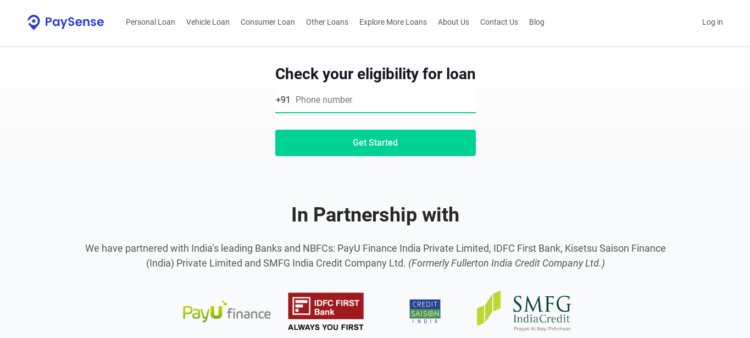

PaySense

PaySense is one of India’s top rapid personal loan apps, and salaried professionals and self-employed people can use it to apply for loans immediately. A personal loan requires a minimum of $18,000 per month in income. To qualify for a loan through the PaySense quick lending app, a self-employed person’s monthly income must be at least $20,000.

The company was formed in Mumbai by Sayali Karanjkar and Prashanth Ranganathan. PaySense has raised a total of $25.6M over three funding rounds. PaySense is available on Google Play. Install the software, then verify your loan’s eligibility. The terms of these loans vary from three months to sixty. The EMI calculator on PaySense simplifies the process of determining your monthly payment. PaySense loans are advantageous because they don’t necessitate a high credit score or collateral.

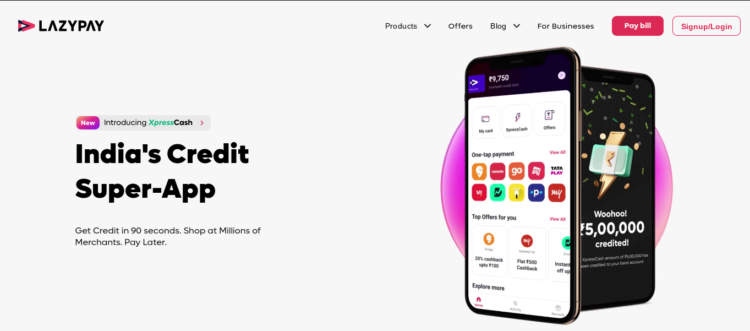

LazyPay

LazyPay is a prominent financing app in India that offers rapid loans and is powered by PayU, which bought PaySense. Online loan applications are processed fast and safely. The LazyPay App makes it easy to determine if you qualify for a loan by just entering your cellphone number. The 1% cashback credit card from LazyPay is another option. LazyPay provides quick personal loans of up to 1,000,000 with easy digital processing and low paperwork requirements.

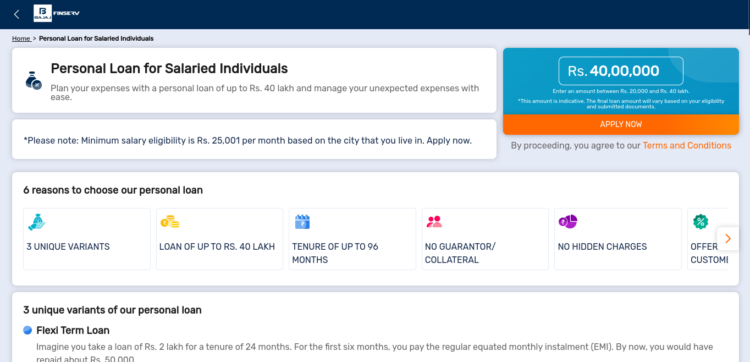

Bajaj Finserv

Personal finance giant Bajaj Finserv has been in the country for over a decade. Bajaj Finserv is one of India’s most excellent fast loan apps with several options. A zero-interest EMI card can fund purchases and pay monthly bills via their loan app. Bajaj Finserv offers personal loans up to ₹25 lakhs without collateral.

IDFC FIRST Bank

If you need a large amount of money for a loan on a vehicle or two-wheeler, use this lending app. If you go through the uncomplicated process, your loan might be approved in minutes. Because of its flexibility, the loan may be repaid in easily manageable installments over one to five years. The company gives its current customers access to information about their loan accounts, including facts on their statements, outstanding amounts, payment dates, and service requests.

Dhani

Indiabulls Ventures back this top Indian personal loan app. Dhani offers personal loans anytime, anywhere, and for any purpose. Unsecured loans can be obtained quickly without collateral. Simply download the app and verify your PAN, Aadhar number, and address. After verification, the loan amount is transferred to the bank account in minutes, or three minutes, according to the app. You can repay the loan in 3–36 months.

HomeCredit

One of India’s oldest money-lending apps. A member of the Home Credit Group, this organization operates in over 10 Asian and European nations. The lending app effortlessly provides the loan amount to aid you with financial issues like college loans or medical situations. This loan offers up to ₹2,40,000 and may be repaid in simple EMIs over 6 to 51 months.

CASHe

CASHe helps get funding for medical or financial emergencies. Just download the CASHe lending app on your phone. It’s on Google Play and Apple Store. After uploading papers via the app, the loan amount is credited to your account in minutes. You can also send loan funds to Paytm Wallet. A proprietary algorithm-based machine-learning technology accepts loans based on the borrower’s social status, merit, and earning potential by CASHe.

KreditBee

KreditBee is one of India’s top online lending apps for young professionals. You can borrow between ₹1000 and ₹2 lakh. Applicants must be 18 years or older and earn ₹10,000 per month to download the app and apply for a loan. The app handles everything, so no physical verification is needed. Verification and permission are required after uploading documents. The loan money is deposited into your bank account after approval. Young professionals seeking a loan for a phone, camera, or laptop love this app.

Fullerton India

Fullerton India makes it simple for self-employed and salaried professionals to apply for personal loans. This is, without a doubt, the best online loan application for freelancers. This online mobile app for personal loans claims to provide instant approval and money transfer within 30 minutes. The app’s straightforward documentation process only needs the most fundamental details. Your loan status is now dynamically trackable.

Fibe

Do you often run out of funds mid-month? Are you worried about paying bills for the rest of the month? When payday is far off, the Fibe lending app helps. For salaried professionals, this app offers loans up to ₹5,00,000 for various reasons. The Pune fin-tech startup lets you repay the loan in 24 months with simple EMIs. Fibe, gaining popularity among youth, secured ₹100 crores in series B fundraising from Eight Roads Ventures and IDG Ventures India.

FAQs

Which immediate personal loan app is best for me?

For the best immediate personal loan app, examine interest rates, fees, payback periods, user reviews, app interface, and customer support. Compare apps, read reviews, and choose one that meets your financial needs and interests.

Can these applications be trusted for financial transactions?

Instant personal loan applications that are trustworthy use superior encryption and security to secure financial transactions and user data. To ensure security, choose applications with strong security, clear privacy policies, and excellent user ratings.

Who may get a loan using these apps?

App eligibility requirements vary every app but usually include age, income, credit score, work position, and nationality. These include being an Indian citizen aged 18–65, having a consistent income, and achieving the app’s minimal credit score.